Who We Are

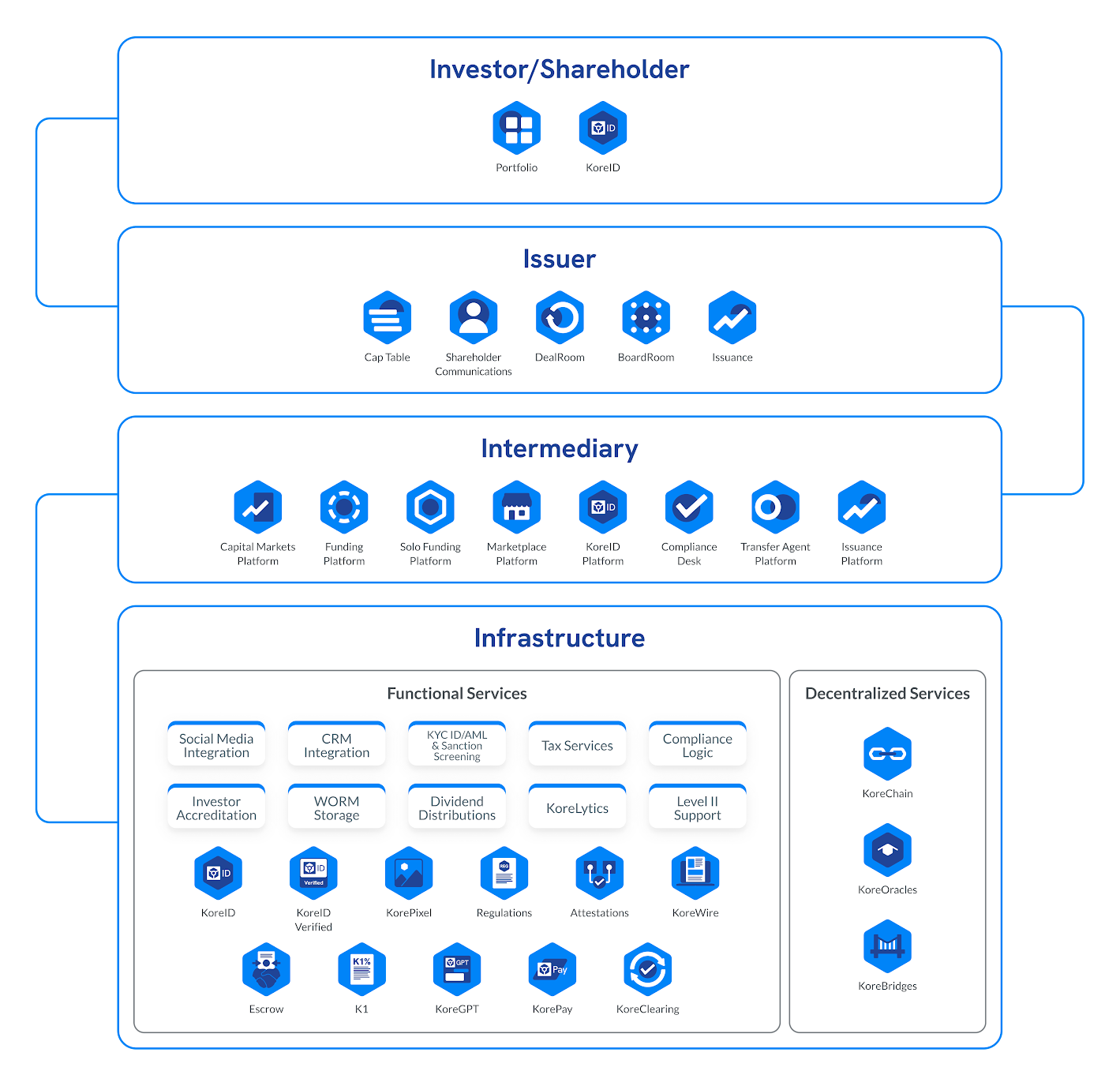

KoreInside is the infrastructure platform for regulated intermediaries in the private capital markets

We provide regulated intermediaries with a fully compliant infrastructure for executing

transactions

KoreInside Ecosystem

The KoreInside Ecosystem comprises primary intermediaries, including broker-dealers, securities lawyers, auditors, secondary market platforms (ATS), transfer agents, share registries, payment processors, custodians, escrow providers, and banks. The Ecosystem also includes firms that provide services such as KYC/AML, tax, corporate secretarial services, investor relations, consulting services, and incorporation services.

The global private capital markets, valued at over $10 trillion, remain fragmented, manual, and opaque. It is plagued by repetitive compliance, redundant identity verification, and disconnected regulatory oversight.

KoreInside transforms this complexity into clarity. We have built the trusted infrastructure for how capital is raised, managed, cleared, settled, and traded. We have ensured that it is done securely, intelligently, and compliantly. Kore continues to adapt and strengthen the infrastructure as regulations and business models change and evolve.

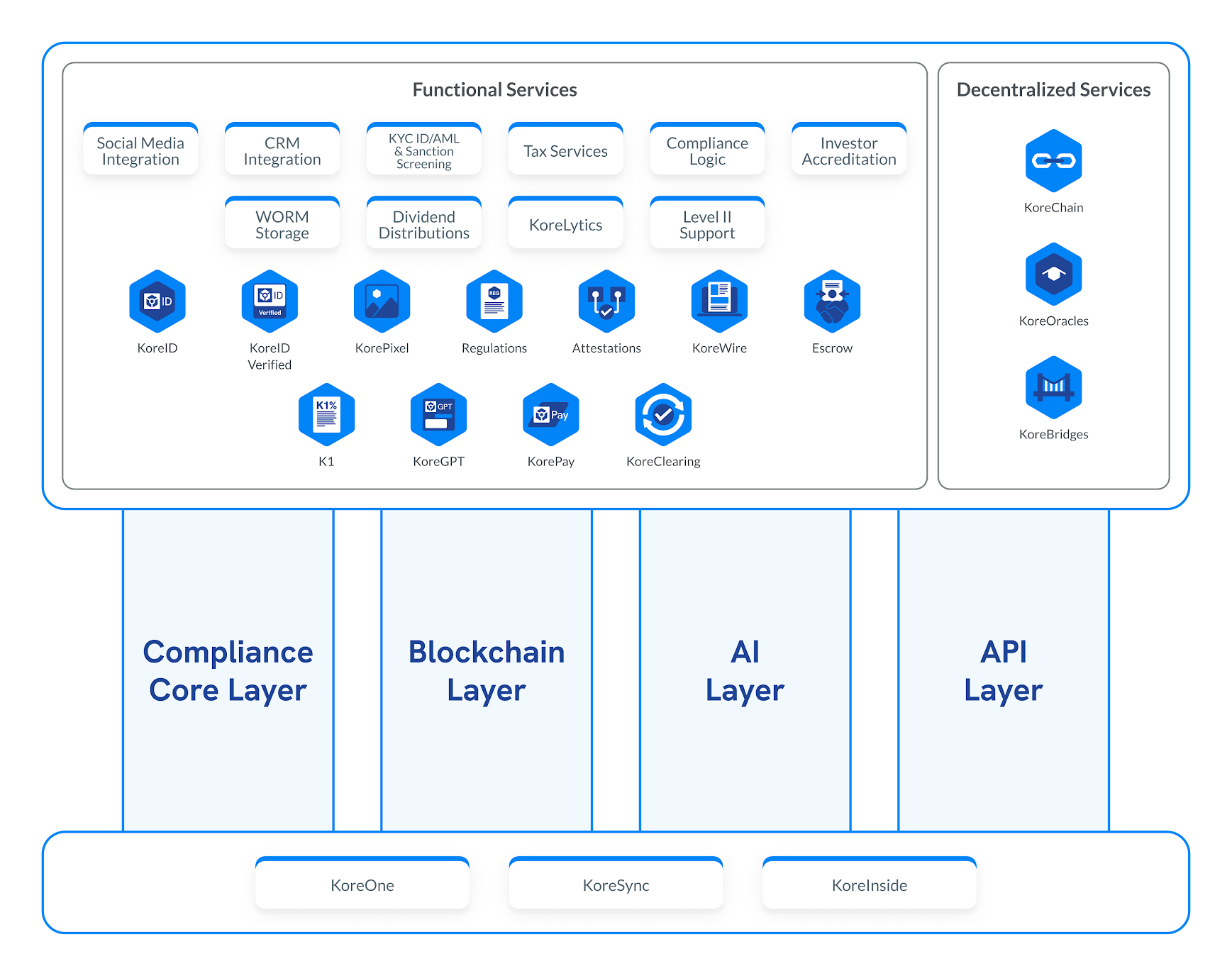

The KoreInside Infrastructure of Trust is powered by four integrated pillars:

- Compliance: Core

- Blockchain: The immutable trust fabric

- AI: The intelligent brain of capital markets

- API Layer: The operational interface for all participants

"Kore is not another platform — it’s the infrastructure upon which the future of private capital will be built.”

David Weild IV, Former Vice Chairman of NASDAQ, Father of the JOBS Act.

Compliance in KoreInside is not merely whitelists or blacklists, but a dynamic and living capability where its four strands of compliance DNA include securities law, corporate law, contract law, and regulation in various jurisdictions globally.

KoreChain is the first SEC-qualified blockchain for private securities, and KoreID, is the digital passport for identity and compliance. Together, they enable an interoperable, compliant, and intelligent capital markets network — a system where trust is not assumed; it’s engineered.

AI is a major component that supports the collection and analysis of investor behavior through the KorePixel, integration with major social media and CRM platforms to power issuance campaigns (with governance provided by the broker-dealers), KoreLytics, that provides segmentation and machine learning capabilities, detection of fraud and compliance issues, and adaptive transaction routing.

KoreInside is built with an API-first philosophy, since Kore is deployed as “KoreInside”, protecting the brand of the intermediaries, issuers, and funding platforms. The KoreInside Ecosystem partners are empowered to build their own UI, UX, and front-end processes. KoreInside API provides the functional logic and compliance checks.

The coordination of data, business processes, and their deployment in the Kore Infrastructure

uses the following three mechanisms:

KoreOne

Unifies business processes across financial paradigms, from traditional finance to digital assets and tokenization. It extends our “all-in-one platform” vision to include KoreChain, enabling seamless interoperability across blockchain networks. KoreOne powers Kore’s native applications, third-party solutions built with Kore Builder, and blockchain-based applications.

KoreInside

The invisible infrastructure with visible assurance. It powers clients’ platforms from behind the scenes, ensuring reliability, security, and compliance while keeping their brands front and center.

KoreSync

The trusted execution layer that ensures cross-mode logic and compliance.

KoreSync technology enables financial instruments to be defined in a platform-agnostic way and implemented consistently across both traditional finance and blockchain environments. This synchronized execution ensures consistency, safety, security, and regulatory compliance. It allows financial transactions and users to move seamlessly between the TradFi and DeFi worlds without disruption or friction.

Example: A shareholder or tokenholder can initiate a transfer request either through their private-label platform (issuer, marketplace, or partner site) or directly from their digital wallet (such as MetaMask).

KOREINSIDE’S VISION: REWIRING GLOBAL CAPITAL MARKETS

Private markets are larger and grow faster than public markets, yet their infrastructure remains outdated. Manual processes, fragmented data, and jurisdictional silos create friction and risk.

KoreInside modernizes the private capital markets from end to end. Our infrastructure creates a connected ecosystem where:

- Issuers launch compliant offerings in days, not months

- Investors use one verified KoreID to invest anywhere

- Regulators gain transparent, real-time visibility

- Institutions integrate seamlessly via Kore APIs

- Application builders are empowered to build 100% compliant solutions using KoreBuilders

Kore is the foundation of the secure operating system for global private capital.

THE FOUR PILLARS OF KOREINSIDE

1. THE COMPLIANCE CORE LAYER

The backbone of KoreInside’s ecosystem, ensuring every transaction is compliant, auditable, and enforceable across jurisdictions.

Core Functions:

- Identity & Access Services: KoreID and role-based permissions

- Regulatory Logic: Jurisdictional mapping and attestations

- Transaction Validation: Integrity verification at every step

- Disclosure & Reporting: Real-time, regulator-ready transparency

- Lifecycle Distributions: Secure, compliant management post-issuance

- Investor Value: Automated trust and cross-border compliance

- Institutional Value: Eliminates redundancy, reduces risk, and embeds regulatory certainty

2. BLOCKCHAIN LAYER — THE IMMUTABLE TRUST FABRIC

KoreChain underpins the ecosystem as the first SEC-qualified blockchain for private securities, embedding legal and compliance logic directly into smart contracts.

Key Features:

- Distributed Ledger: Legally auditable ownership and compliance records

- KoreContracts: Legal-first, AI-assisted smart contracts

- Oracle-Based Interoperability: Bridges to Ethereum, Polygon, Avalanche—without compromising regulation

KoreChain turns blockchain into a compliance engine — legally enforceable, regulator-trusted, and future-proof.

3. AI LAYER — THE INTELLIGENT MIND OF CAPITAL MARKETS

The intelligence layer that transforms static data into predictive, actionable insight.

Capabilities:

- Smart Routing: Matches investors and opportunities within compliance bounds

- Legal Reasoning Engine: Translates plain-English rules into executable code

- Predictive Compliance: Detects anomalies and flags violations before they occur

- Natural Language Interface: KoreGPT answers compliance and operational questions contextually

AI at Kore isn’t an add-on — it’s the intelligence running through every transaction.

4. API LAYER — EMPOWERING MARKET PARTICIPANTS

Where issuers, investors, and intermediaries engage directly with Kore’s compliant digital ecosystem.

Reference Turnkey Applications:

- Kore Issuance & DealRoom – End-to-end offering management

- Kore Compliance Desk – Automated KYC/AML and due diligence

- Kore Transfer Agent Platform – Real-time shareholder management

- Portfolio & Cap Table Management – Transparent investor records

Integration: Open APIs enable partners and certified developers (via Kore Builders) to extend functionality without compromising compliance.

INTEROPERABILITY & ECOSYSTEM SYNERGY

Kore’s architecture operates like a four-layer neural system:

- Compliance Layer → Brainstem (compliance reflexes)

- Blockchain Layer → Spinal Cord (immutable execution)

- AI Layer → Intelligence (learning and prediction)

- API Layer → Cortex (user interaction)

Together, they form an adaptive, compliance-first ecosystem — a living infrastructure that powers every participant in private capital.

WHY KOREINSIDE MATTERS NOW

The global shift toward digital assets and regulatory modernization is accelerating. Investors demand liquidity. Regulated Intermediaries (Broker-Dealers, ATS, Funding Platform) are demanding distribution for their Issuer clients. Regulators demand transparency. Institutions demand scalability and interoperability. All of this occurs in the context of convergence.

KoreInside is ready:

- SEC-qualified blockchain — unmatched regulatory credibility

- AI-native compliance intelligence — continuous automation and monitoring

- Proven infrastructure — powering issuance, trading, and transfer at scale

This isn’t the next platform

— it’s the next foundation.

THE FUTURE IS KOREINSIDE

The future of capital markets will be built on trust, transparency, and intelligence — not fragmentation. KoreInside is engineering that future now.

Through KoreChain, KoreID, and KoreGPT, we unify issuers, investors, intermediaries, and regulators under one infrastructure of truth. We don’t replace the market — we connect it.

KoreInside: Where Compliance Meets Intelligence, and Trust Becomes the Infrastructure.

The Infrastructure that is required to operate this complex, fragmented ecosystem

Robust, trustworthy

KoreOne+KoreSync = KoreInside

The Power of the KoreInside Infrastructure

The End-to-End Backbone for the Private Capital Markets

KoreInside Infrastructure is the most comprehensive, secure, and compliant digital operating system for the private capital markets. From broker-dealers and transfer agents to investors, banks, and regulators, KoreInside empowers every participant in the ecosystem to transact faster, cheaper, and 100% compliantly—all while building trust across the value chain.

Layer 0: KoreInside Infrastructure – The Operating System of Private Capital Markets

Often described as “The Foundation” or “The Motherboard” of the private capital markets, KoreInside Infrastructure is more than just software—it's a tightly integrated stack of:

- Software

- Data

- Integrations

- KoreChain (blockchain-native trust)

- KoreLytics (AI, Machine Learning, and Data Analytics)

Together, these components create an immutable, compliant, and intelligent infrastructure capable of transforming how private capital is raised, managed, traded, and reported.

KoreInside Infrastructure Foundation Architecture

| Category | Capabilities |

|---|---|

| Digital Identity | KoreID, Certification, Verification |

| AI & Intelligence | KoreGPT, AskGPT, KoreAgent, KoreLytics (AI, ML, DA) |

| Financial Tools | NAV, W9/W8, K1, FATCA, CRS, TradeCheck, KorePay (Payments & Escrow) |

| Compliance & KYC | KYC, Sanction Screening, Investor Verification, DD, Bad Actor Check |

| Transfer & Custody | Transfer Agent Services, Custodian Integration |

| Data & APIs | Multi-source data feeds (ATS, RIA, Public), Full API suite |

| Core Transaction Engine | Tokenization (Securities, NFTs), KoreContracts (Functional Compliance Logic), Wallets, Oracles, Bridges |

| Governance & Reporting | Regulatory Filings, Government Policy Integration, Newswire, Regulator Attestations |

| UX & White-Label | KoreApp (Mobile), Multi-Tenant, SMTP, White/Private Label Portals |

| Storage & Security | KoreStore (WORM + KoreChain), Routing, Multi-Sig Authentication |

KoreInside Infrastructure Support Architecture

To support ecosystem-wide integration and rapid adoption, Kore provides:

- Reference Solutions (Private Label, Configurable Templates)

- API-Direct Access for Solution Providers & Developers

- Toolkits for Third-Party Integrators

- Training & Certifications for Vendors & Builders

Applications Powered by Kore Infrastructure

- Compliance Desk

- Issuance Platform

- Cap Table Management

- Portfolio & Shareholder Communications

- DealRoom & Capital Markets Platform

- Funding Platforms (Traditional & Solo)

- Marketplace & Transfer Agent Platforms

- KoreAsk (AI-powered Inquiry Platform)

What Kore Infrastructure Delivers to All Participants

Whether you're a Broker-Dealer, ATS, Funding Platform, Marketplace, Issuer, Bank, Law Firm, Investor, or Shareholder, Kore provides:

Trust & Transparency

Immutable records, compliance-first architecture, and auditable trails build trust across all transactions.

Efficiency & Speed

Automated workflows, data-driven decisioning, and integrated compliance logic allow participants to move faster without sacrificing oversight.

Lower Costs

By eliminating redundant processes and intermediaries, Kore reduces transaction costs while increasing accuracy and throughput.

Real-Time Updates & Insights

Live data feeds, analytics, and sector intelligence give participants an always-on pulse of the market.

Day-to-Day Enablement

Pre-built templates, attestations, filings, and smart contracts streamline daily operations for all roles.

Lower Costs

By eliminating redundant processes and intermediaries, Kore reduces transaction costs while increasing accuracy and throughput.

Kore Infrastructure is the only end-to-end ecosystem built specifically for the private capital markets, ensuring regulatory confidence, transaction security, and operational agility—at scale.

Kore Infrastructure Support Architecture:

- Reference Solutions

- (Private/White Label, configurable)

- API-Direct for Solution Providers

- Tools for Third-Party Devs

- Training and Certifications for Vendors