by Oscar Jofre | Mar 8, 2023 | Capital Markets, Capital Raising

In recent years, the number of female entrepreneurs has grown exponentially. Many women have decided to turn their business ideas into reality. Others have leveraged the resources available to expand an existing business. Despite data suggesting that female-led...

by Oscar Jofre | Mar 6, 2023 | Capital Markets, Capital Raising, Compliance

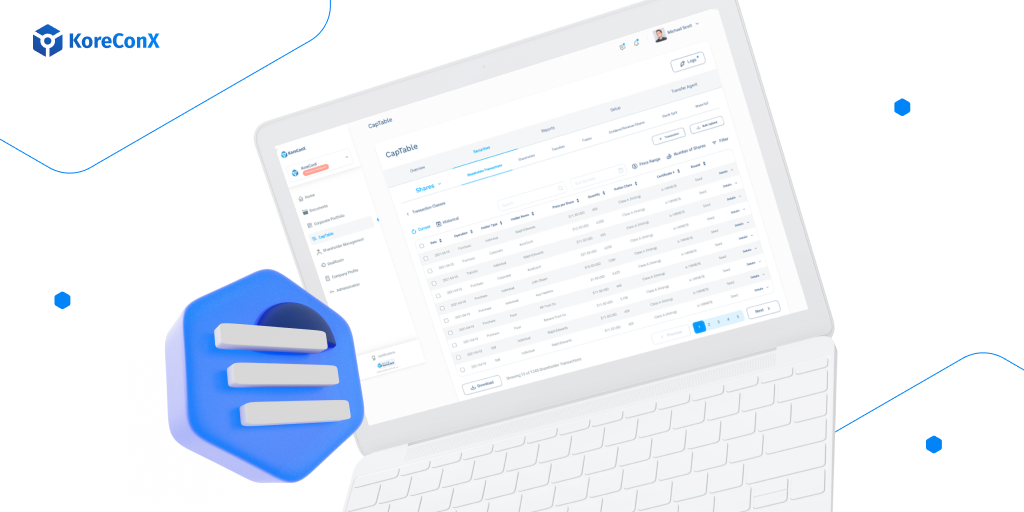

A cap table (short for capitalization table) is essential for any company looking to raise capital. It provides a detailed breakdown of the equity owned by shareholders, enabling founders to understand how their offerings will be impacted and make sound decisions...

by Oscar Jofre | Mar 3, 2023 | KoreConX

Elevare Technologies is a technology company aiming to lead the digital economy revolution through Virtualization as a Service (VaaS). They promote and accelerate virtual adoption globally creating custom virtual experiences and worlds for teams, clients, and...

by Oscar Jofre | Mar 1, 2023 | Investors, Issuers

When it comes to raising capital using Regulation Crowdfunding (RegCF), due diligence is an essential part of the process. Due diligence helps ensure that the company offering securities complies with all applicable laws and regulations and that investors are fully...

by Oscar Jofre | Feb 27, 2023 | Investors, Issuers

Due diligence is an essential part of the investment process. Especially following the passage of the JOBS Act in 2012, which expanded Regulation A+ (RegA+), companies now have additional opportunities to seek capital from investors. This has created a need for due...