Kore Blogs

September 30, 2025

Stablecoins, the GENIUS Act, and the Future of Payments

Stablecoins began as an interesting innovation in the crypto world to offer a “stable investment” or safe haven in volatile markets. But with regulatory pressure from the GENIUS Act, the survival of stablecoin issuers hinges on their becoming payment rails rather than speculative vehicles. The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) […]

Latest posts

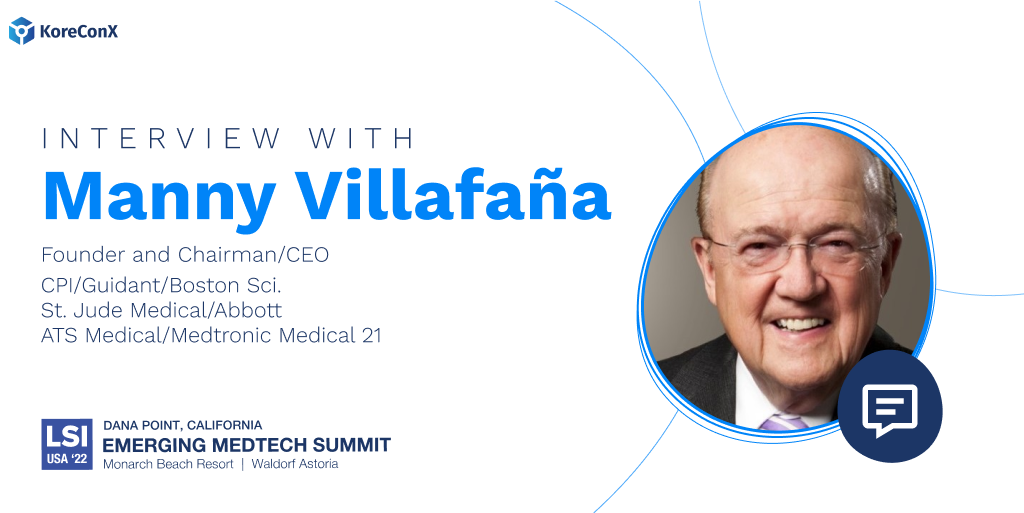

February 17, 2022

KoreClient Spotlight: Manny Villafaña, CEO and Founder of Medical21

Manny Villafaña has a long track record of innovation in the medtech space, delivering solutions to improve cardiac care and surgical procedures. In his latest venture, Manny is creating a product that will change the way cardiac bypass surgeries are performed, improving patient outcomes. We sat down with Manny to discuss his company, the […]

February 16, 2022

Why is Your Community of Investors Important?

When companies begin the capital raising journey, it is no longer about going public or simply getting a company’s product in front of venture capitalists. To be successful in our current capital raising landscape with Regulations A+ and CF, organizations must build a community of investors. This not only brings life to your business, but […]

February 14, 2022

How to be Ready for Raising Capital

Whether you’ve raised capital in the past or are preparing for your first round, being properly prepared will help your company secure the funding it needs. Proper preparation will make investors confident that you are ready for their investments and have a foundation in place for the growth and development of your company. So if […]

February 11, 2022

What is Rule 12(g)?

Rule 12(g) is a crucial rule that affects all issuers, but many issuers don’t start with it in mind. The rule began with the 1934 Exchange Act, and it states the threshold at when an issuer must register securities with the SEC. Read further to learn what rule 12(g) does and why it’s essential. […]

February 8, 2022

KoreConX and David Weild IV at LSI Emerging Medtech Summit 22

‘Father of the JOBS Act,’ Mr. Weild will join KoreConX to address a keynote on how Medtech is the new frontier to a successful capital raising NEW YORK, February 8, 2022 – KoreConX and its partner, Life Science Intelligence, are bringing together top thought leaders in the private capital markets environment to the Emerging Medtech […]

February 7, 2022

What is Regulation S?

It is essential to be familiar with the different regulations that govern how companies can raise capital in today’s business world. One important rule is Regulation S. This article will give you a basic overview of Regulation S, how it affects businesses, and how companies can use it to raise capital. What is Regulation […]

February 4, 2022

KorePartner Spotlight: Scott Pantel, President & CEO of Life Science Intelligence

With the launch of the KoreConX all-in-one platform, KoreConX is happy to feature the partners contributing to its ecosystem. During the capital raising journey, many things must be in place to increase the potential for success. One of these critical factors is having the right team to assist with gaining information on your demographic […]

February 2, 2022

The Recipe for a Successful RegA+ Offering

If your company is looking to raise funding, you’ve probably considered many options for doing so. Since the SEC introduced the outlines for Regulation A+ in the JOBS Act in 2012 and its subsequent amendments, companies are able to raise amounts up to $75 million during rounds of funding from both accredited and non-accredited investors alike. […]

January 31, 2022

How to Read a Startup’s Financial Statements

This article was originally written by our KorePartners at StartEngine. View the original post here. When considering which startups to invest in, there is some key information prospective investors would want to review and understand before making any investment decision. A lot of the information is presented to you on campaign pages, but if […]

January 28, 2022

What is Regulation A+?

Regulation A+ (RegA+) was passed into law by the SEC in the JOBS Act, making it possible for companies to raise funding from the general public and not just from accredited investors. Since March 2021, companies have been able to take advantage of the limit’s increase to $75 million. This provides companies the ability to […]

January 26, 2022

How RegA+ Helps Pre-Revenue Companies

For many pre-revenue companies, especially started by first-time entrepreneurs, capital comes from sources like personal savings, credit card debt, friends, or family. However, when it comes to raising a significant amount of capital for growth, they might not have the market validation needed to secure funding from traditional sources. With Regulation A+ equity crowdfunding, these […]

January 26, 2022

KoreConX Partners With LSI Emerging Medtech Summit 2022

Medtech and Life Sciences main event will be held next March in California. KoreConX is one of the supporting sponsors. NEW YORK, January 26, 2022 – KoreConX is pleased to announce its partnership with LSI Emerging Medtech Summit 2022, which will be held March 15-18, 2022, in Dana Point, California, USA. This is a major […]

January 24, 2022

Reg A Offering : When is it the right offering type?

This post was originally written by our KorePartners at Capital Raise Agency. View the original post here. There are a lot of questions we get from potential clients or people that hire us for consulting on their fund around Reg A offerings but one of the main ones is what type of fund should I […]

January 19, 2022

How Regulation Crowdfunding Will Reach $5 Billion

“We are adopting amendments to facilitate capital formation and increase opportunities for investors by expanding access to capital for small and medium-sized businesses and entrepreneurs across the United States.” – SEC, 2021 The continuous maturation of the crowdfunding industry has resulted in growth in the development of businesses and innovation. Since 2016, there have […]

January 17, 2022

Investing in Startups 101

This article was originally written by our KorePartners at StartEngine. You can view the post here. The high-speed world of startups, and the risks of investing in them, are well documented, but startup investing can be complicated and there is a lot of information you should know before making your first investment. This article will […]

January 14, 2022

KorePartner Spotlight: Andrew Bull, Founding Partner Bull Blockchain Law

With the recent launch of the KoreConX all-in-one platform, KoreConX is happy to feature the partners contributing to its ecosystem. During the capital raising journey, many components must be in place to increase the potential for success. One of these critical factors is ensuring that a capital raise meets regulatory compliance requirements. This means […]

January 12, 2022

Using RegA+ For Collectibles

RegA+ is a securities exemption that allows companies to raise capital from accredited and unaccredited investors. There has been a lot of interest around Regulation A+ and its potential uses for companies outside of the traditional tech and biotech sectors. In this post, we’ll take a look at how RegA+ could be used to offer […]

January 10, 2022

How Does Social Media Impact RegCF Offerings?

Reg CF allows companies to raise up to $5 million through an SEC-registered intermediary. Since increasing this limit from $1.07 million in 2021, private companies have raised over $1 billion in Reg CF offerings. This highlights Reg CF’s incredible success in opening the doors to capital for these issuers. For many of these offerings, social […]

January 7, 2022

Private Securities and Crowdfunding Surge is Forecast to Continue in 2022

This article was written by our KorePartners at Rialto Markets. View the original post here. Crowdfunding had another record year in 2021 and is forecast to soar even higher in 2022. According to Pitchbook data, global crowdfunding exploded from $8.61 billion in 2020 to $113.52 billion last year – a 1,021% increase. The US market alone […]

January 5, 2022

How Have the JOBS Act Exemptions Impacted Company Founders?

Since the JOBS Act was passed in 2012, it has been easier for company founders to raise money with exemptions like Reg CF and Reg A+, changing the landscape of private capital investments. The JOBS Act provides exemptions from registration for private companies raising money with key benefits, like: Ability to keep the company […]