The Solution

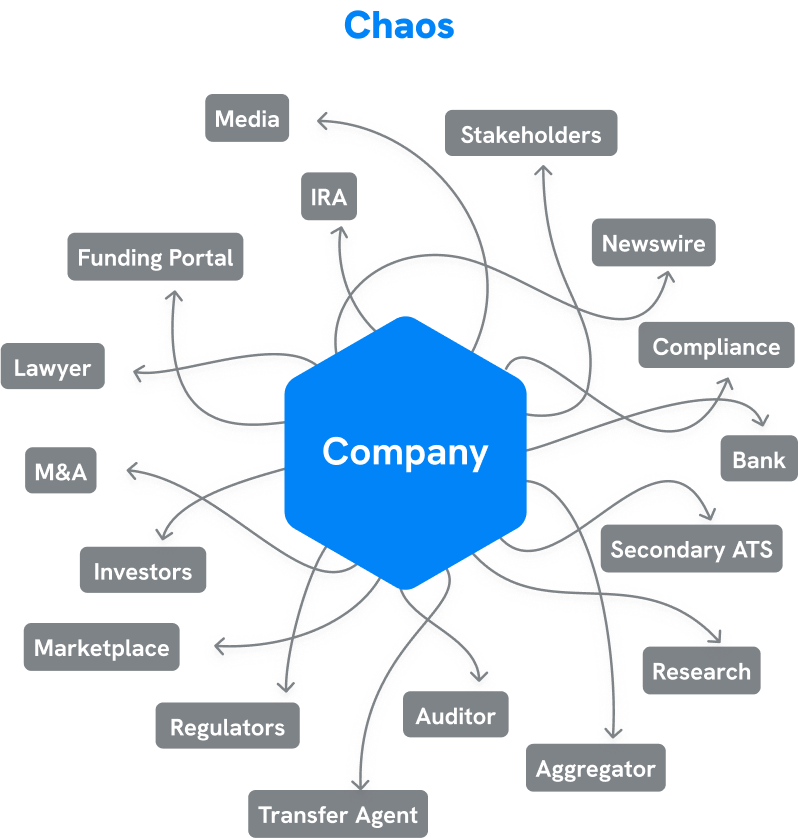

The JOBS Act of 2012 aimed to democratize access to private capital markets, valued at $4.45T. When it was launched, the industry was not ready. There were a variety of unknown participants who tried to operate with no infrastructure or integrated technology solutions.

Since then, solutions were created by or for broker-dealers, secondary market operators, and funding platforms. However, these solutions remain fragmented, leading to operational inefficiencies, high costs, and compliance deficiencies.

This fragmentation creates friction and erodes trust among regulated intermediary participants.

- $4.45T Private Market

- Plagued by inefficient tools, fragmented processes, and high costs.

- NO Trust, Unreliable Company & Investor Data

Private Capital Markets are currently experiencing unprecedented growth. But with this growth comes some hefty challenges. Think redundancy, a lack of a central truth source, excessive effort, and sky-high costs.

A key obstacle within Private Capital Markets lies in the accumulation of disparate tools aimed at addressing various organizational needs. The problem is, they don't talk to each other properly. There's no common data interchange format (CDIF), so the info you need is all over the place. It's like trying to find a needle in a haystack.

Consequently, a fragmented communication landscape emerges where crucial data remains compartmentalized and identifying a reliable source becomes increasingly difficult.

Recognizing these challenges, KoreInside and KoreChain have developed a comprehensive solution. Tailored for FINRA Broker-Dealers, KoreInside Platforms is innovative and offers enhanced efficiency and connectivity, providing a seamless experience for navigating this dynamic landscape.

Solutions

Broker-Dealers

Platform Operator Solutions

Real Estate Solutions

Transfer Agents Solutions

Broker-Dealer Solutions

Who They Are

Broker-dealers, whether introducing or executing, are the gatekeepers of compliant capital raising and secondary market transactions in the private markets. They manage investor onboarding, deal syndication, transaction workflows, compliance, and reporting.

How KoreInside Supports Broker-Dealers

KoreInside provides a full-stack infrastructure designed for broker-dealers to operate 100% compliantly across primary offerings and secondary trading. With integrated modules for onboarding, order management, disbursements, issuance, and post-trade cap table updates, broker-dealers can focus on deal flow while KoreInside automates the compliance and operations backbone.

Included Modules

| Module | Purpose |

|---|---|

| KoreID | Reusable, blockchain-verified investor identity with KYC/AML, suitability, accreditation, sanction screening, and history |

| API | Connect KoreInside’s infrastructure to internal BD systems or third-party applications |

| Compliance Desk | Real-time validation of exemptions (RegCF, RegD, RegA+, RegS, S-1), jurisdictions, and investor eligibility |

| Deal Distribution | Manage deal placement, syndication, and investor allocations |

| Disbursement | Automate payments to issuers, broker-dealers, and investors post-close |

| OMS (Order Management System) | Track and process primary and secondary orders with full compliance enforcement |

| Portfolio | Broker-dealer view of investor holdings and transaction history |

| Tokenization | Issue digital securities embedded with compliance logic for automation and transparency |

| Transfer Agent | Issue, transfer, and manage ownership records with regulatory compliance |

| DealRoom | Present live offerings with real-time investor activity and documentation flow |

Key Outcomes for Broker-Dealers

- Accelerated compliance workflows for onboarding and transactions

- Seamless integration with internal deal systems via API

- Reduced operational burden on legal and compliance teams

- Scalable infrastructure for multi-exemption offerings

- Enhanced transparency for regulators, issuers, and investors

Platform Operator Solutions

Who They Are

Platform Operators run or require white-labeled or proprietary investment platforms that support multiple issuers, a variety of asset types, including collectibles, medtech, healthcare, music, art, cars, real estate, fractional ownership, and tokenized securities, and serve diverse investor classes such as retail, accredited, qualified purchasers, and institutional investors. These platforms enable issuers to raise capital under all JOBS Act exemptions, including RegCF, RegD, and RegA+, while the platform infrastructure itself remains regulation-neutral and infrastructure-focused.

How KoreInside Supports Platform Operators

KoreInside provides a modular, regulation-compliant infrastructure that allows platform operators to manage multi-issuer investment ecosystems while supporting capital raises across exemptions and asset classes. Kore empowers operators to offer robust onboarding, investor dashboards, offering portals, compliance enforcement, and post-investment management without having to build and maintain that infrastructure in-house.

Included Modules

| Module | Purpose |

|---|---|

| KoreID | Streamlines investor onboarding with reusable identity and compliance credentials |

| API | Connect KoreInside's backend infrastructure to any front-end platform or CRM system |

| Compliance Desk | Automates jurisdictional and exemption-specific validation (RegCF, RegD, RegA+) |

| Collectibles | Supports the listing, fractionalization, and trading of collectibles and digital assets |

| Compass | Command center for platform operators to oversee investor flows, issuer activity, and compliance events |

| Disbursement | Automates profit-sharing, returns, and other distributions based on investment terms |

| Deal Distribution | Syndicates' offerings across multiple investor networks or integrated platforms |

| DealRoom | White-labeled interface where issuers can host and manage live capital raises |

| OMS (Order Management System) | Manages order intake, investor eligibility, and transaction validation in real-time |

| Portfolio | Enables investors to monitor all holdings across issuers, asset classes, and exemptions in one place |

Key Outcomes for Platform Operators

- Launch custom, scalable platforms across industries and asset types

- Support issuers raising capital under RegCF, RegD, and RegA+

- Serve all investor types with a fully compliant onboarding and transaction flow

- Enable multiple offerings, disbursements, and post-investment tracking in one system

- Ensure long-term scalability with API-connected infrastructure and modular design

Real Estate Solutions

Who They Are

Multi-sponsor real estate firms offer private investment opportunities to a wide range of investors, including retail, accredited, qualified purchasers, and institutional participants. These firms raise capital through multiple JOBS Act exemptions including RegCF, RegD, RegA+, and S-1, and often support fractional ownership models to lower entry barriers and expand investor access. Offerings may include private REITs, individual assets, multi-property portfolios, and tokenized real estate.

How Kore Supports Real Estate Firms

KoreInside provides a complete infrastructure that enables real estate firms to launch, manage, and scale capital raises with embedded compliance, investor onboarding, digital issuance, disbursements, and post-raise cap table management. The platform supports complex deal structures, multiple exemptions, and multi-issuer configurations, while automating every stage from offering setup to investor payouts.

Included Modules

| Module | Purpose |

|---|---|

| KoreID | Investor identity verification and reusable compliance credentials across multiple offerings |

| API | Seamless integration into CRMs, investor portals, or fund administration tools |

| Compliance Desk | Real-time compliance enforcement for RegCF, RegD, RegA+, and S-1 offerings |

| Cap Table | Real-time ownership ledger and updates for fractional or full property shares |

| Compass | Admin dashboard for managing exemptions, investor status, and regulatory flags |

| DealRoom | Present live real estate offerings with document access, investor interest tracking, and call-to-action flows |

| Disbursement | Automate monthly/quarterly distributions based on share class or fractional interest |

| Deal Distribution | Push offerings to partners, RIAs, and broker-dealer networks through syndication tools |

| OMS (Order Management System) | Track subscription orders, eligibility checks, and funding verification |

| Portfolio | Centralized investor view of all real estate investments across multiple sponsors and offerings |

Key Outcomes for Real Estate Firms

- Support capital raising under multiple exemptions with one infrastructure

- Enable fractional ownership and manage compliance across investor classes

- Automate cap table updates and shareholder distributions

- Offer investors seamless onboarding and portfolio visibility

- Manage multiple sponsors and offerings under one scalable system

Transfer Agent Solutions

Who They Are

Transfer Agents are responsible for managing the issuance, transfer, and ownership records of securities, ensuring accurate shareholder recordkeeping, regulatory compliance, and corporate action execution for both traditional and digital securities.

How Kore Supports Transfer Agents

KoreInside supports both SEC-registered Transfer Agents and organizations that wish to become transfer agent back-office providers for private companies and investment platforms. KoreInside provides a modern, digital-first infrastructure that enables transfer agents to scale operations with full compliance. From share issuance to ownership transfers and disbursements, every transaction is tracked immutably on KoreChain, verified by the Compliance Desk, and linked to real-time shareholder identities through KoreID. The system supports integration with issuance platforms, broker-dealers, and marketplaces, making KoreInside the transfer agent backbone for the private capital markets.

Included Modules

| Module | Purpose |

|---|---|

| KoreID | Verifies shareholder identity, KYC/AML, and accreditation with reusable compliance credentials |

| API | Connect KoreInside’s infrastructure to external admin systems, CRMs, or fund servicing tools |

| Compliance Desk | Ensures transfers are compliant with investor eligibility, exemptions, and jurisdictional rules |

| Cap Table | Maintains accurate, real-time ownership records across issuers, offerings, and classes |

| Compass | Admin control center for shareholder management, compliance status, and historical logs |

| DealRoom | Interface to track investment activity, ownership updates, and transfer requests |

| Disbursement | Automates corporate actions like dividends, buybacks, redemptions, and interest payments |

| OMS (Order Management System) | Tracks and validates ownership changes tied to trades or subscriptions |

| Shareholder Communications | Deliver investor updates, regulatory notices, and corporate resolutions securely |

| Tokenization | Enables issuance and management of digital securities with built-in transfer restrictions and compliance logic |

Key Outcomes for Transfer Agents

- Launch or scale transfer agent operations with a compliant digital infrastructure

- Maintain accurate, secure, and immutable shareholder records

- Automate complex corporate actions and reduce manual overhead

- Enable seamless connectivity with issuers, marketplaces, and broker-dealers

- Provide regulatory transparency through KoreChain-backed audit trails

Modules

- Compliance Desk

- Issuance

- Investment Banking

- Funding Platform (FP)

- Capital Markets Platform (CMP)

- Marketplace Platforms (MKP)

- Solo Funding Platform (SFP)

- Decentralized Funding Platform (DFP)

- Tokenization

- Private Capital Markets Passport (KoreID)

- Order Management System (OMS)

- Transfer Agent Platform (TAP)

- All-In-One Platform

- Kore Clearing

- Kore Payments

- Kore Wire

- API

All platforms are white-labeled, fully integrated with the KoreInside Infrastructure, KoreChain, KoreNode, KoreID, and the Compliance Desk, with tailored regulatory support across the JOBS Act exemptions and beyond.

Compliance Desk

KoreInside’s Compliance Desk is the centralized compliance engine that supports real-time rule enforcement across multiple offering types: RegCF, RegD (506b & 506c), RegA+, RegS, and S-1. It integrates with the entire financial ecosystem, including payment rails, crypto wallets, RIAs, IRAs, and banks. It ensures end-to-end automation of regulatory logic, onboarding checks, and cross-border compliance—anchored to KoreChain for transparency and auditability.

Key Features:

| Real-time regulatory validation for RegCF, RegD, RegA+, RegS, S-1 | Investor KYC/AML screening |

| Accreditation verification (auto or manual) | Cross-border investor checks (e.g., RegS) |

| Compliance logic via smart contracts | Jurisdictional rule engine |

| Integration with fiat and crypto payments | Wallet whitelisting and ownership tagging |

| Investor limit enforcement (e.g., RegCF) | Compliance with anti-fraud & “bad actor” rules |

| Full audit logs via KoreChain | Investor profiling for RIAs |

| IRA account validation and linking | Pre-trade and post-trade compliance tracking |

| FINRA Rule 17a-4 recordkeeping compatibility | Token restriction enforcement by investor class |

| Alerts for KYC expiration or accreditation lapses | Configurable compliance workflows |

| Real-time updates to law and policy changes | Exemption-specific document requirement checks |

| Risk rating and red-flag analytics | Geo-fencing and jurisdictional filtering |

| Shareholder classification for SEC filings | Seamless integration across Kore platforms |

| AI-driven compliance pattern detection (optional module) |

Issuance Platform (IP)

The Issuance Platform allows companies to launch and manage offerings under RegCF, RegD, RegA+, RegS, and S-1. With full integrations into the Compliance Desk, SEC-registered Transfer Agent, and a real-time DealRoom, this white-labeled solution enables compliant, live fundraising management from end to end, including digital securities issuance and investor onboarding.

Key Features:

| KoreID passport for private capital markets fully integrated | Multi-regulation support (RegCF, RegD, RegA+, RegS, S-1) |

| KoreChain smart contract-based issuance | Compliance Desk rule enforcement |

| SEC-registered Transfer Agent integration | DealRoom for live investor activity tracking |

| Full white-label customization | Investor onboarding and accreditation |

| ACH, wire, credit card, crypto payments | Escrow account management |

| Real-time cap table updates | Digital subscription agreement generation and signing |

| Investment document storage and access | Support for equity, debt, SAFEs, convertibles |

| Tier-based share class configuration | Shareholder communication tools |

| Broker-dealer compliance integration | KYC/AML via KoreID and third-party vendors |

| Share issuance + vesting configuration | Audit-ready data exports |

| Multi-language/multi-currency compatibility | Geo-fenced investor access |

| Investment progress dashboard | Pre-launch data room setup |

| Legal compliance checklists by exemption | Transfer agent certificate automation |

Investment Banking Platform (IBP)

The Investment Banking Platform is designed for registered broker-dealers, investment banks, and placement agents to manage private placements under RegD, RegA+, RegS, and S-1. It supports full lifecycle deal management—from origination and syndication to compliance, investor onboarding, and transaction execution—while integrating seamlessly with the Compliance Desk, Transfer Agent, and KoreChain.

Key Features:

| KoreID passport for private capital markets fully integrated | Private placement management for RegD, RegA+, RegS, S-1 |

| Deal origination dashboard with status tracking | Investor and issuer CRM tools |

| Syndicate and advisor management module | Secure data room for diligence materials |

| Smart contract-backed transaction flow | Compliance Desk integration for every offering |

| Accredited investor onboarding via KoreID | E-signature and legal document workflows |

| Tiered access control for multi-party deals | Real-time deal analytics and activity logging |

| KYC/AML enforcement with audit history | Broker-dealer regulatory sync and reporting |

| Custom workflows for internal compliance checks | Document timestamping and versioning |

| Automated investor suitability scoring | Email templates and investor communication tools |

| Cap table integration for issuer post-close | Multi-currency and multi-jurisdiction support |

| Pre-deal pitch decks and deal teasers module | Fundraising pipeline management (deal stage tracking) |

| Transfer Agent and OMS integration | Commission tracking and reporting tools |

| Post-offering reporting and client deliverables | S-1 bridge for public deal preparation |

Funding Platform (FP)

The Funding Platform is a white-labeled, RegCF-only solution used by funding portals, incubators, and community-based capital networks. It enables compliant crowdfunding, investor onboarding, escrow integration, and live fundraising visibility. It's built for scalability, regulatory precision, and ease of use for both issuers and investors.

Key Features:

| KoreID passport for private capital markets fully integrated | RegCF-specific rules engine |

| Compliance Desk integration for per-investment validation | KYC/AML screening for all investor types |

| Investment cap enforcement for non-accredited investors | Support for both individual and entity investors |

| Custom white-label branding per platform | Subscription agreement automation and e-sign |

| KoreID onboarding and investor history | ACH, wire, credit card, and crypto payment options |

| Escrow setup and compliance management | Offering page builder and campaign configuration |

| Real-time funding tracker (DealRoom-style) | Cap table auto-updates |

| Multi-issuer dashboard for platform operators | Automated compliance documentation generation |

| Investor communication and update tools | Audit log and document retention for SEC compliance |

| Mobile-friendly UI and investor flow | Investor interest soft-circling and waitlist |

| Integration with transfer agent for final issuance | Visual dashboards for campaign performance |

| Multi-language and time zone compatibility | Investment receipts and investor portal |

| Disbursement workflow with milestone logic | Pre-offering review and approval workflow |

Capital Markets Platform (CMP)

The Capital Markets Platform (CMP) is an enterprise-grade solution designed to manage digital and traditional securities under RegCF, RegD, RegA+, RegS, and S-1. It supports full lifecycle management of private capital—offering investor onboarding, ownership tracking, corporate actions, reporting, and compliance. Fully integrated with the Compliance Desk, Transfer Agent, and Order Management System, CMP is the core engine for managing and scaling digital securities infrastructure.

Key Features:

| KoreID passport for private capital markets fully integrated | Support for RegCF, RegD, RegA+, RegS, and S-1 |

| Integrated Compliance Desk validation | Real-time investor onboarding with KoreID |

| Full cap table management and sync | Corporate actions: dividends, splits, conversions |

| Support for multiple asset classes (equity, debt, funds) | Tokenization-ready for digital issuance |

| Smart contract event automation | Shareholder registry and governance tools |

| Role-based access control (issuer, admin, investor) | Cross-jurisdictional support with audit logging |

| Multi-offering and multi-series security management | Integrated investor dashboards |

| Share class customization (preferred, common, etc.) | Customizable notifications and reporting |

| Legal document archive and signing tools | Voting and proxy module for shareholder actions |

| Integration with Transfer Agent and OMS | Tax document generation and export |

| Compliance alerts and workflow triggers | Secondary trading support with MKP integration |

| Real-time ownership updates via KoreChain | Documented audit trails for regulators |

| IRA and RIA compatibility | Public listing prep tools (bridge to S-1 path) |

Marketplace Platform (MKP)

The Marketplace Platform is purpose-built for secondary trading of RegA+ LLC Series assets. It enables compliant peer-to-peer transactions, price discovery, and fractional ownership trading. Integrated with ATS partners, the Compliance Desk, KoreID, and Order Management System, it brings transparency, liquidity, and compliance to the private markets.

Key Features:

| KoreID passport for private capital markets fully integrated | RegA+ LLC Series-specific trading functionality |

| Integrated ATS trading execution | Order matching engine with smart contracts |

| Compliance Desk validation on every trade | KoreID verification and investor eligibility |

| Wallet-based digital security storage | Secondary market order book and depth tracking |

| Fractional ownership and series-level tracking | Cap table update post-trade |

| Cross-platform KoreChain transaction logging | Bid/ask trade negotiation interface |

| Whitelist-based access control for investors | AML/KYC re-verification before trade clearance |

| Integrated tax and cost basis tracking | Investor trade history and downloadables |

| Integration with OMS and Transfer Agent | Mobile-optimized trading interface |

| IRA and crypto-compatible trading workflows | Broker-dealer execution support |

| Automated trade confirmation and receipts | Regulatory reporting export features |

| AI trade monitoring for suspicious activity | Synchronous funding and settlement flows |

| Price history and charting interface | Share repurchase tools for issuers |

Solo Funding Platform (SFP)

The Solo Funding Platform is a streamlined, white-labeled solution built exclusively for multi-sponsor real estate companies to raise capital directly—with intermediaries. Ideal for offerings under RegCF, RegD, or RegA+, the platform gives sponsors complete control over the investor journey while ensuring automated compliance through KoreChain, the Compliance Desk, and optional integration with Kore’s Transfer Agent and DealRoom.

Key Features:

| KoreID passport for private capital markets fully integrated | RegCF, RegD, and RegA+ offering support |

| Self-managed issuer dashboard | Real-time investor onboarding with KoreID |

| Built-in KYC/AML and accreditation checks | Subscription agreement workflow |

| Compliance Desk rule enforcement per investment | ACH, wire, credit, and crypto payments |

| Automated escrow setup and fund release | Cap table updates in real time |

| Offer creation wizard (equity, debt, SAFEs, notes) | Transfer Agent connectivity (optional) |

| Digital security issuance using smart contracts | Campaign progress tracking (deal room-style insights) |

| Investor communication and Q&A interface | Mobile-optimized investor experience |

| Custom branding and domain mapping | Document hosting and digital signing |

| Alerts for accreditation/KYC expiration | Auto-generated audit trail and export tools |

| Compliance checklists and offering templates | Fractional ownership and multiple share classes |

| Post-offering cap table maintenance | RIA/IRA investor support |

| Multi-language and jurisdiction toggle | Pre-configured for integration with CMP, TA, OMS |

Decentralized Funding Platform (DFP)

The Decentralized Funding Platform (DFP) is built exclusively for FINRA-registered Broker-Dealers operating under U.S. Regulation Crowdfunding (RegCF). It provides end-to-end control over issuers, investors, and offerings while ensuring strict adherence to SEC and FINRA requirements. Fully integrated with the Kore Compliance Desk, the platform automates KYC, AML, accreditation, and disclosure monitoring. Broker-dealers benefit from a seamless workflow that streamlines onboarding and reduces administrative friction. With scalable infrastructure, the DFP enables firms to expand RegCF operations confidently and efficiently.

Key Features:

| KoreID passport for private capital markets fully integrated | Built for multi-party decentralized fundraising |

| DAO/syndicate-compatible offering structure | RegCF, RegD, RegA+ exemption support |

| Role-based access for issuers, admins, and agents | Smart contract-backed governance and approvals |

| Real-time compliance enforcement via Compliance Desk | Wallet-based investor onboarding and verification |

| Crypto and fiat payment options | Escrow support for pooled capital |

| Document collaboration and e-signatures | Tokenized equity and fractional ownership support |

| Accreditation checks for pooled backers | Investor interest tracking and whitelist tools |

| Real-time campaign analytics per participant | Integration with KoreID for all investors |

| Transaction and voting audit trails | SPV and entity setup configuration |

| Cross-jurisdictional compliance logic | Automated cap table updates by DAO share |

| Transfer Agent and Tokenization integration | Fund disbursement rules with milestone logic |

| Multiple asset type offering support | IR tools for managing syndicate updates |

| KYC refresh, expiration alerts, and investor lockouts | Secondary market readiness with MKP compatibility |

Tokenization

KoreInside’s Tokenization solution transforms traditional and alternative assets into compliant digital securities backed by smart contracts and recorded on KoreChain. Ideal for equity, debt, funds, or fractional ownership, this platform embeds regulatory logic directly into tokens and ensures full compatibility with secondary trading (MKP) and lifecycle governance (CMP).

Key Features:

| Tokenization of equity, debt, funds, and hybrids | KoreChain smart contract deployment |

| Built-in compliance logic for exemptions and jurisdictions | SEC-compliant digital security attributes |

| Oracle to any public chain (Polygon, Avalanche, Ethereum, etc) | Cap table synchronization post-tokenization |

| Wallet issuance and investor linking | Investor eligibility and ownership tracking |

| Real-time KoreID verification | Fractional ownership support |

| Transfer restrictions by exemption or investor class | Primary and secondary market readiness |

| Geo-fencing and jurisdiction tagging | Token certificate generation |

| Cross-platform asset interoperability | Multi-asset issuance capabilities |

| Compliance Desk enforcement on token transfers | Automated dividends, vesting, and distributions |

| Cap table transparency via blockchain | Regulatory metadata embedded in token |

| Multi-chain compatibility (Ethereum, Polygon, etc.) | On-chain audit trail and timestamping |

| Re-issuance and cancellation support | Transfer Agent integration |

| AML/KYC requirement enforcement via smart contracts | Full integration with CMP, MKP, OMS |

KoreID – Private Capital Markets Passport

KoreID is a blockchain-verified, reusable identity solution designed for investors, issuers, and intermediaries in the private capital markets. It links compliance credentials, investment history, and identity verifications to a single portable profile—enabling frictionless access across all KoreInside-enabled platforms with real-time validation through the Compliance Desk.

Key Features:

| KoreID passport for private capital markets fully integrated within all platforms | Blockchain-anchored digital identity |

| Reusable across all KoreInside platforms | KYC/AML status stored and updated in real-time |

| Accreditation status (verified and timestamped) | KoreChain-backed audit history |

| Investor transaction history | Compliance passport for multi-platform use |

| Jurisdiction-specific eligibility logic | Privacy-controlled data sharing |

| Cross-border investment compatibility | Wallet linkage and identity sync |

| Investor suitability and risk profiling | Status refresh notifications (e.g., expiring KYC) |

| Full support for entities and trust structures | Compatibility with RegCF, RegD, RegA+, RegS |

| Secure credential storage and encryption | Integration with Transfer Agent and OMS |

| Regulator-ready reporting and logs | Digital certificate of compliance readiness |

| Linked investment history across offerings | Escrow and payment method validation |

| API availability for third-party platforms | Integration with RIA/IRA onboarding systems |

| White-label option for platforms and advisors | Instant eligibility checks for investments and trading |

Order Management System (OMS)

The Order Management System (OMS) facilitates compliant, real-time order processing across both primary offerings and secondary market trades. Integrated with the Compliance Desk, KoreID, ATS platforms, and KoreChain, the OMS ensures investor eligibility, regulatory enforcement, and full trade lifecycle transparency—from order initiation to settlement and cap table updates.

Key Features:

| KoreID passport for private capital markets fully integrated | Centralized trade order intake and tracking |

| Real-time investor eligibility validation via Compliance Desk | KoreID-based investor verification |

| Integration with ATS for execution and reporting | Smart contract-driven order routing |

| Investor wallet verification and linking | Order book visibility and trade matching |

| Multi-asset order handling (equity, debt, funds) | KYC/AML enforcement at order level |

| Pre-trade compliance confirmation | Post-trade cap table and ledger sync |

| On-chain audit trail via KoreChain | Escrow confirmation and payment tracking |

| Order status updates and investor notifications | Synchronized integration with CMP and MKP |

| Cross-border trading validation | Trade reconciliation and correction workflows |

| RIA/IRA channel compatibility | Multi-party trade workflow approval |

| Order archiving for regulatory review | Mobile-friendly investor order access |

| Support for RegD, RegA+, RegS, and secondary trades | Broker-dealer and agent execution monitoring |

| Tax tracking and cost basis logs | Visual dashboards for platform admins |

Transfer Agent Platform

KoreInside’s Transfer Agent Platform provides SEC-registered transfer agent services, automating ownership recordkeeping, share transfers, corporate actions, and compliance across both traditional and tokenized securities. Deeply integrated with CMP, OMS, KoreID, and the Compliance Desk, it ensures immutable ownership records and efficient regulatory reporting for issuers and investors.

Key Features:

| KoreID passport for private capital markets fully integrated | SEC-compliant transfer agent capabilities |

| Real-time shareholder registry updates | Automated share issuance and cancellation |

| Digital and traditional security support | Cap table synchronization with CMP |

| Corporate actions (splits, dividends, buybacks) | Ownership ledger verification on KoreChain |

| Integrated investor onboarding with KoreID | Share certificate creation and delivery |

| Transfer approval workflow with compliance checks | Transaction timestamping and audit logging |

| KYC/AML re-verification at point of transfer | Restricted security handling with lockups |

| Cross-border share transfer enforcement (e.g., RegS) | Escrow and payment reconciliation support |

| Role-based access for issuers and agents | Share class customization and rights management |

| Document repository for investor actions | IRA and RIA integration for managed accounts |

| Automated notifications for corporate actions | Multi-language and jurisdictional support |

| Periodic shareholder reports and statements | Data export for Form D, 10-K, or Blue Sky compliance |

| Whitelist/blacklist enforcement via Compliance Desk | Integration with MKP and OMS for full trading lifecycle |

All-In-One Platform

The All-In-One Platform is KoreInside’s unified, fully integrated interface that connects core capital markets functions—including cap table management, shareholder communications, investor portfolios, DealRoom, BoardRoom, and personal investor profiles—into a single, secure, mobile-accessible experience. Purpose-built for issuers, investors, advisors, and board members, it centralizes visibility and action across all Kore-powered solutions. Fully integrated with KoreID, the Compliance Desk, KoreChain, and KoreInside’s mobile app, it is the modern command center for the private capital markets.

Key Features:

| KoreID passport for private capital markets fully integrated | Unified dashboard for issuers, investors, and board members |

| Live Cap Table with real-time updates across offerings | Investor Portfolio View (across RegCF, RegD, RegA+, RegS) |

| Shareholder communication center with message templates | DealRoom module for active offerings and soft-circled interest |

| Embedded BoardRoom for board votes, resolutions, and docs | Personal Profile with KoreID-linked credentials |

| SEC-compliant document management and signature flow | Smart contract triggers for ownership and action logging |

| Role-based access control (issuer, advisor, investor, board) | Compliance Desk integration across all modules |

| Secure login with multi-factor authentication | Cross-platform data sync via KoreChain |

| Real-time investment tracking and notifications | Voting system for shareholder and board decisions |

| Share class-specific shareholder communication tools | Mobile app access for iOS and Android (fully synced) |

| View-only investor access for advisors or family offices | Task manager for regulatory or shareholder follow-ups |

| Audit-ready export tools for investors and regulators | Escrow status visibility for in-progress deals |

| Private chat threads per offering or board group | Automatic linking to Transfer Agent for ownership changes |

| Multi-offering history and document access | Multi-language and international investor support |

The All-In-One Platform brings together essential capital markets operations in one fully integrated environment. Designed for issuers, investors, advisors, and board members, it includes Cap Table, Shareholder Communications, Portfolio, DealRoom, BoardRoom, Personal Profile, and a Mobile App—offering a real-time, unified experience for managing ownership, investments, governance, and compliance across the private capital ecosystem.

Cap Table

10 Key Features:

- Real-time ownership tracking across all securities

- Multi-share class structure with voting rights

- Smart contract-driven cap table automation

- Integration with Transfer Agent and OMS

- Real-time updates from primary/secondary transactions

- Export-ready for legal, audit, and regulatory use

- Cross-platform syncing with CMP and Tokenization

- Shareholder-level access permissions

- Cap table visualization (pie charts, waterfall, etc.)

- Custom vesting schedules and founder equity tools

Shareholder Communications

10 Key Features:

- Direct messaging to individual or all shareholders

- Templates for corporate actions, reports, and announcements

- Attach and distribute investor documents securely

- Shareholder segmentation by share class or investor type

- Real-time read receipts and engagement tracking

- Voting integration for corporate decisions

- Automated notification for dividends and updates

- Language customization for global investors

- Full audit log of communications

- Compliance filtering through the Compliance Desk

Portfolio

10 Key Features:

- Unified investor dashboard across all investments

- Real-time valuation and allocation display

- Cross-regulation asset support (RegCF, RegD, RegA+, RegS)

- Linked transaction history via KoreChain

- Investment certificates and share details per company

- Status indicators for active, pending, exited investments

- Downloadable reports and capital call history

- Dividend tracking and reinvestment options

- KoreID-linked investment passport integration

- IRA/RIA portfolio views for managed accounts

DealRoom

10 Key Features:

- Live fundraising tracker for each offering

- Soft-circled investor interest dashboard

- Document vault with e-signature integration

- Investor Q&A board

- Status-based investment funnel (e.g., viewed, subscribed, funded)

- Compliance Desk-driven access controls

- Issuer updates and offering bulletins

- Integrated subscription and payment workflows

- Downloadable term sheets and pitch decks

- Audit trail of investor interactions

BoardRoom

10 Key Features:

- Role-based access for directors, officers, observers

- Resolutions and board vote tracking

- Meeting scheduling and notifications

- Document sharing with version control

- Digital board minutes and signatures

- Private messaging and group threads

- Secure file sharing (strategy, governance, legal)

- Voting rights tied to share classes

- Real-time vote result calculation and history

- Regulatory and compliance documentation support

Personal Profile

10 Key Features:

- KoreID integration for reusable identity and compliance data

- Accreditation, KYC/AML, and investment history status

- Digital signature profile for document execution

- Multi-entity role management (e.g., investor + director)

- Real-time compliance credential validation

- Linked wallets and bank accounts for transactions

- Risk profile and suitability scoring

- Communication preferences and notification settings

- Data privacy controls and sharing permissions

- Cross-platform profile sync for all KoreInside apps

Mobile App

10 Key Features:

- Real-time access to portfolio, cap table, and documents

- Biometric login and two-factor authentication

- Mobile DealRoom interaction and investing

- Push notifications for offers, votes, and communications

- BoardRoom access for meetings and voting

- Secure investor messaging

- Multi-role support (investor, board member, issuer)

- Offline access to stored documents and investment history

- Mobile document signing and action approval

- Available on iOS and Android, KoreInside-branded or white-label