Kore Blogs

September 30, 2025

Stablecoins, the GENIUS Act, and the Future of Payments

Stablecoins began as an interesting innovation in the crypto world to offer a “stable investment” or safe haven in volatile markets. But with regulatory pressure from the GENIUS Act, the survival of stablecoin issuers hinges on their becoming payment rails rather than speculative vehicles. The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) […]

Latest posts

September 4, 2018

KoreChain – Interactive Item – Validation

EcoSystem Layer – Validation Perform business validation of transactions.

September 4, 2018

KoreChain – Interactive Item – Verification

EcoSystem Layer – Verification Verify identity; provide KYC, KYP, AML; conduct investor suitability and risk profiling.

July 9, 2018

A Big Lesson from the Delaware Blockchain Amendments

Andrea Tinianow, the founding director of the Delaware Blockchain Initiative (and ‘Blockchain Czarina’), recently published a very insightful article on the significant gap in the mainstream protocols for security tokens. The gap is in the way the Delaware Blockchain Amendments are interpreted by the mainstream security token platforms. The Delaware Blockchain Amendments were an outcome […]

June 27, 2018

A Security Token for Full Lifecycle Compliance

ICOs suffer from disapproval from not only the SEC but also several media that have banned ICO advertising. This disapproval seems justified, since many of the ICOs had no business plans, no product, no service, no credible team, and no roadmap for generating value. Of the remaining well-intentioned ones, the problem of passing regulatory scrutiny for […]

June 26, 2018

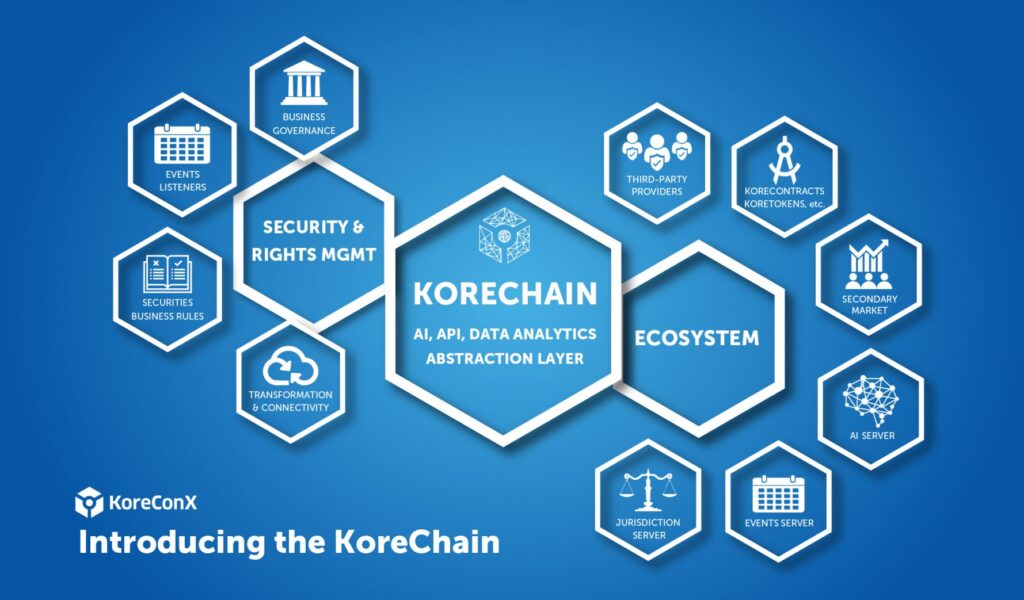

Introducing the KoreChain

The KoreChain is the first blockchain on a serious industrial-strength infrastructure that is focused exclusively on the complex world of global financial securities. The KoreChain is a permissioned Hyperledger Fabric blockchain. This gives it the native advantage of Fabric, a blockchain platform that has been engineered from the ground up for handling enterprise-class applications. KoreChain […]

June 4, 2018

Capital Raising "Capital markets point of view" dealer

For private issuers, raising capital is the next natural step once you have exhausted other traditional forms of financing. It becomes even more enticing when you read about other firms doing it, and thinking why shouldn’t that be us. However, being prepared to take the issuer to the next level can be a source of […]

May 15, 2018

What is Investor Relations for Private Companies?

While Investor Relations may seem like an all-encompassing term referring to the relationship between investors and the company that they invest in, in practice the definition is more precise. Investor Relations professionals are tasked with providing investors with up-to-date information on company affairs, so that private and institutional investors stay informed on the goings of […]

May 1, 2018

StartUp Law 101

Late last year I had the opportunity to collaborate with Catherine Lovrics, B.A., LL.B at Bereskin & Parr LLP, on the inner workings of raising capital for entrepreneurs. Her book, Startup Law 101: A Practical Guide, published last week. The basis of our conversations surrounded accessing funding at the right time and identifying the the […]

April 22, 2018

Today Investors Want

The internet changed everything when it was first introduced but it has not been until now that Broker Dealers, Exempt Market Dealers (EMD) are playing catch up to what clients expect from them. Investor want this today: They ask for all this because in other parts of their daily lives they are doing their tasks […]

April 12, 2018

What is Portfolio Management?

Anyone that invests in more than one company or investment asset has a portfolio of investments to manage. With global markets opening up and alternative finance platforms such as P2P (Peer to Peer) or Equity Crowdfunding platforms we are seeing a variety of new investments in private companies becoming available to non-accredited investors (non high […]

April 9, 2018

Hiring in the Securities Industry: What you Need to Know

Hiring a new employee can be challenging in any environment, but it’s even harder in the securities industry. Employee not only have to be the right choice for the firm, but they must also pass muster with the securities regulators who approve registration. In reviewing an application for registration, the regulators focus on three key […]

February 28, 2018

Proficiency Requirements

Securities legislation is quite clear on what courses and designations you need in order to register in the various categories, but what relevant experience is sufficient is less clear cut. No matter the category you are applying under, the regulators must determine than individual is fit for registration. They look at the proficiency of the […]

February 6, 2018

The Death of the ICO and the RISE of #TAO

The term ICO has been very confusing to the investing market, even those selling ICOs have no understanding of it — when you start asking questions people give you a look like a deer caught in headlights. So, what does ICO stand for? #ICO = Initial Coin Offering COIN = CURRENCY = MONEY The most […]

January 25, 2018

Product Due Diligence (Company/Issuer)

Dealing Representatives are only allowed to sell products that have been approved by the Chief Compliance Officer (CCO) — and only after they’ve been trained on a product features, risks and costs. Depending on your firm’s size, product due diligence may be performed by the CCO herself, or by a dedicated corporate finance team. Here’s […]

January 23, 2018

Wild Wild West of ICO’s time to move over, Regulated ICO’s are coming (#TAO)

Those that can remember the wild wild west of crowdfunding back in 2010-2011 will have a feeling of dejavu seeing the 2017 ICO market take off. Not that crowdfunding ever saw the numbers that we are seeing in the ICO market, but that is because the securities regulators stepped in early when crowdfunding launched in […]

January 5, 2018

Investor Relations Hashtag #IRPrivate

I know what you are thinking, why on earth do a blog regarding a hashtag. Clearly everyone knows what Investor Relations (IR) is and how to find it. I felt that it was time to launch a new tool to find information about private companies online for 2018. Like any good article I wanted to make sure […]

January 2, 2018

The Good, The Bad, and the Confusing Messaging

Think of yourself standing in front of a room full of strangers, about to give a speech on particle physics. You don’t know if they are experts on the topic, or know nothing at all. You don’t know what their interests are, what they think you’re going to tell them, what they want to hear […]

December 14, 2017

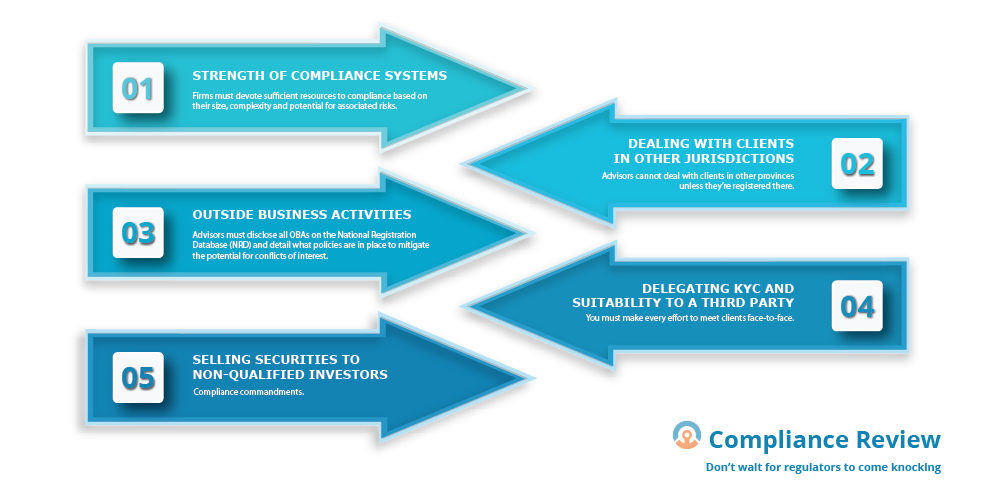

Compliance Review

Compliance Review Compliance reviews by regulators follow a prescribed format depending on what has triggered the visit, whether a full compliance review, targeted review or a for-cause review based on information that has come to their attention. But, during any type of review, there are certain deficiencies that are more significant than others. Here’s what […]

December 8, 2017

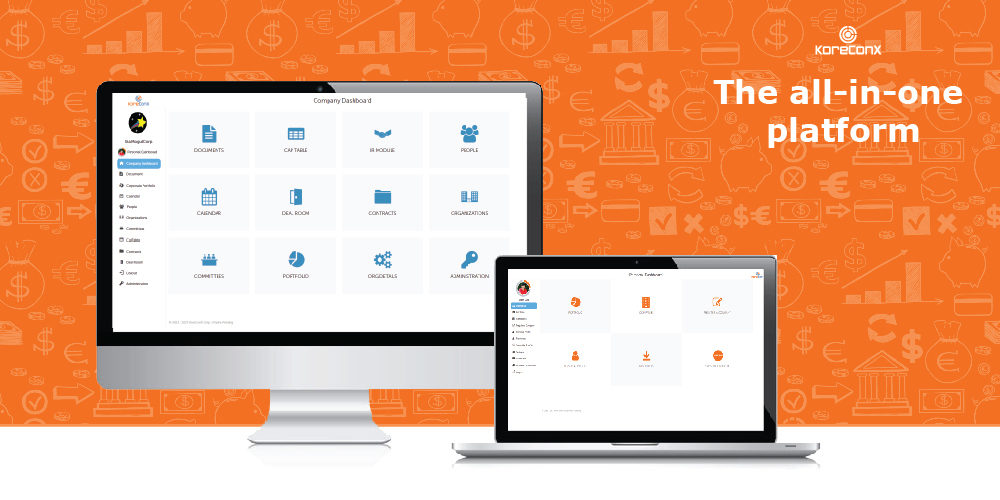

Happy 2nd Anniversary KoreConX !

We are so excited to be celebrating the 2nd year anniversary of the KoreConX all-in-one business platform launch. It’s amazing how fast the past 2 years have gone by. We have made friends all over the world who have shared their stories of how they use KoreConX to manage their investments with our Portfolio Management tool and how managing their companies corporate information is so easy.

November 16, 2017

Yes ONE login Yes ONE platform

The All-in-ONE platform The promise land of technology since the early days (going back to the 80’s) was to have one platform to make us more efficient, bring us online to collaborate and connect to a variety of other technology services like Fintech, InsurTech, LegalTech, RegTech, etc. The internet changed a lot for businesses and […]