by Oscar Jofre | May 25, 2020 | Broker Dealer, Capital Markets, Capital Raising, FINRA, KoreChain, KoreConX, KoreProtocol, Regulation, SEC

FINRA BD Requirements for RegA+ & Digital Securities The private markets are receiving a much updated revamp by the SEC which is having a major impact on registered FINRA Broker-dealer firms. Here are two (2) of the most common activities for which FINRA...

by Oscar Jofre | Apr 5, 2020 | Capital Markets, Capital Raising, Digital Securities, FINRA, KoreConX, Legal, Regulation, SEC, Transfer Agent

The simple answer is that today, Regulation A (Reg A) and Regulation A+ (Reg A+) are the exact same law. There is no difference, and the two terms may be used interchangeably. Some confusion stems from the two similar terms, and there is much misleading information...

by Oscar Jofre | Mar 10, 2020 | Capital Markets, Capital Raising, CapTable, Digital Securities, Investor Relations, KoreProtocol, Regulation, SEC, Secondary Markets, Security Token, Transfer Agent

It’s never too early in the process of building a company to start managing your capitalization table (otherwise known as a cap table). As a detailed document recording all information regarding shareholders and the equity owned in the company, a well-managed...

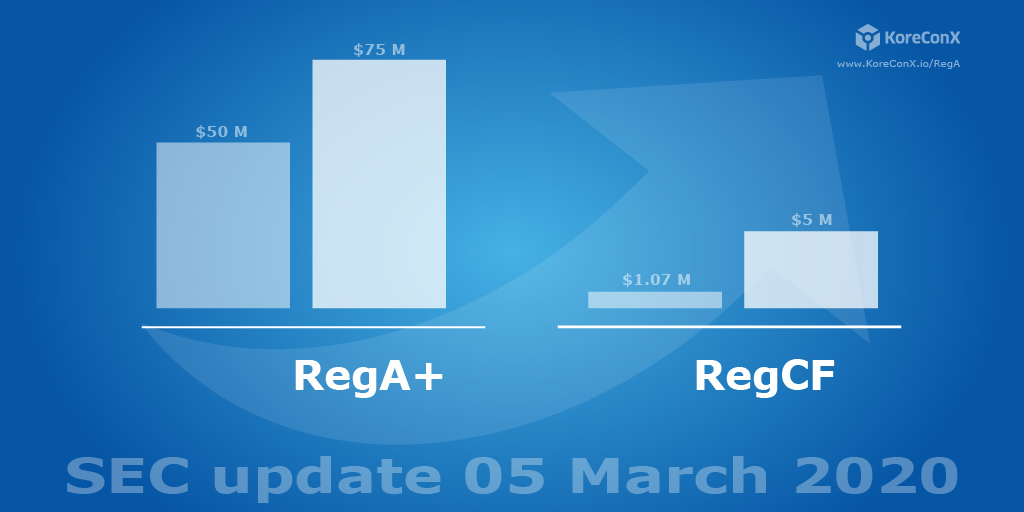

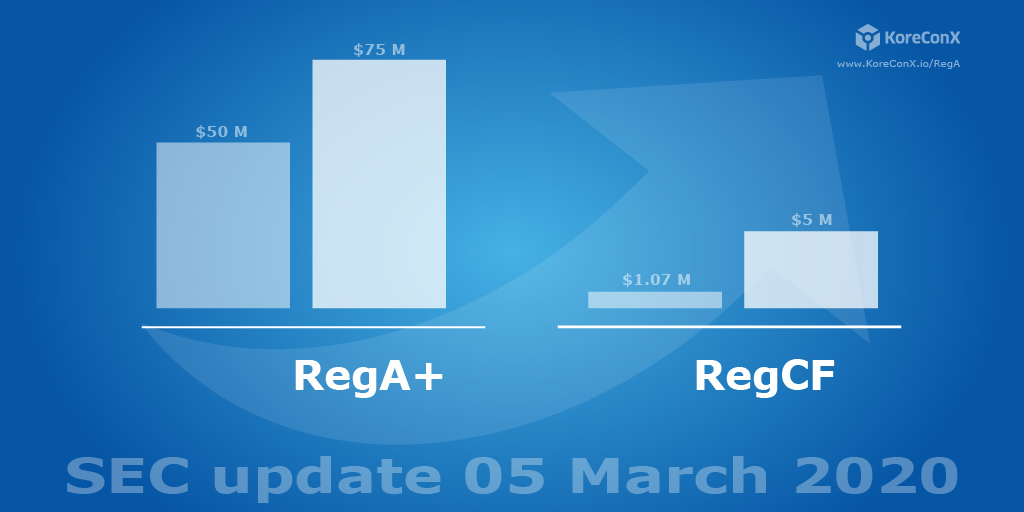

by Oscar Jofre | Mar 5, 2020 | Capital Markets, Capital Raising, CapTable, Compliance, Digital Securities, FINRA, Investor Relations, SEC, Secondary Markets

On 04 March 2020, the US Securities Exchange Commission (SEC) has laid out the proposed changes that are going to have a major impact on the private capital markets. This is very positive for the market. These changes have been in the works for a number of years and...