KoreInside Blogs

February 20, 2026

Why No Syndicates in Private Capital Markets? Is It as Simple as Greedy Bankers?

In the high-stakes world of capital raising, public markets operate like a well-oiled machine: vast sums are mobilized through lead bankers and sprawling syndicates, ensuring deals cross the finish line.

Latest posts

April 5, 2020

What is Reg A plus versus Reg A?

The simple answer is that today, Regulation A (Reg A) and Regulation A+ (Reg A+) are the exact same law. There is no difference, and the two terms may be used interchangeably. Some confusion stems from the two similar terms, and there is much misleading information about this online. I’ve even spoken at events where […]

March 10, 2020

Why is my cap table so important for my company?

It’s never too early in the process of building a company to start managing your capitalization table (otherwise known as a cap table). As a detailed document recording all information regarding shareholders and the equity owned in the company, a well-managed cap table will become essential to long term success. Even if you’re thinking that […]

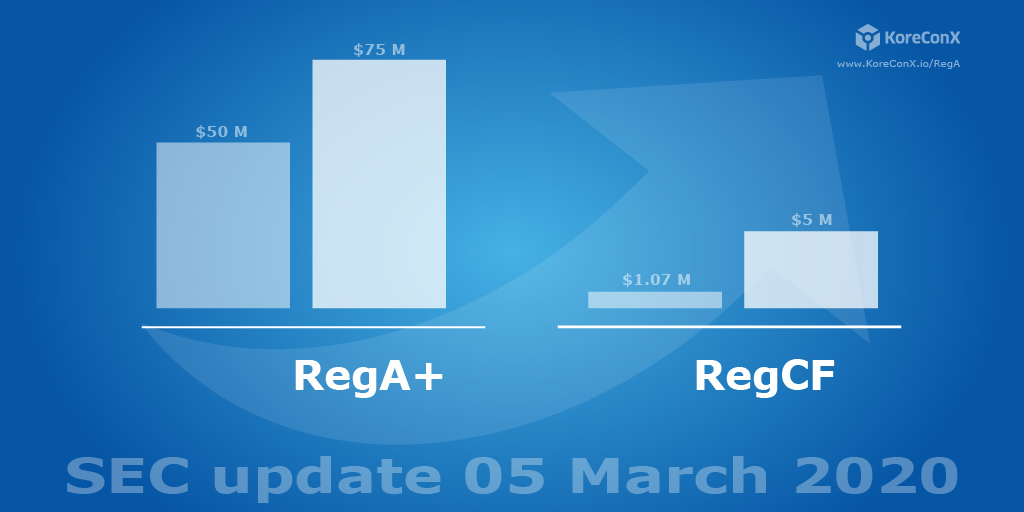

March 5, 2020

SEC changes to RegA+ and RegCF

On 04 March 2020, the US Securities Exchange Commission (SEC) has laid out the proposed changes that are going to have a major impact on the private capital markets. This is very positive for the market. These changes have been in the works for a number of years and many in the industry have advocated […]

January 21, 2020

Wake up call, do you have the right chain for securities?

Polymath is the latest of the Ethereum fan club that has woken up to the fact that Ethereum isn’t the right blockchain platform for financial securities. The reasons include the permissionless and unverified participants, gas fees, unpredictable settlement, poor performance, and lack of scalability. Vitalik himself was the first to point this out way back […]

November 27, 2019

Finality, Settlement, and Validation: The Place to Start

One of the most important concepts in capital market transactions is settlement and finality. Even though the payment infrastructure gets the majority of airtime, settlement finality is just as, if not even more, important in the securities markets. In the public markets, the structure of securities and the clearance and settlement process is quite standardized. […]

November 9, 2019

Global Crypto Twins one on one with Oscar Jofre co-founder of KoreConX

The Crypto Twins are well-recognized faces in the blockchain space and have been advocates and the voice for those who are supporting the global ecosystem of digital securities formation. This was a great interview by the Crypto Twins to gain insight from a global leading authority on where the market is moving towards. What is […]

November 8, 2019

Blockchain Radio's one on one with KoreConX Chief Scientist/Technology Officer

This is a rare occasion to have our very own Dr. Kiran Garimella interviewed by Blockchain Radio’s Pierre Bourque, a leading talk show host for blockchain enthusiasts. Kiran highlights the need for trust, compliance, and investor protection in the private capital markets. This is why the participants on the KoreChain and the owners of KoreNodes, […]

November 7, 2019

Midas Letter James West interviews CEO of KoreConX

The Midas Letter show is hosted by personality James West, who gets right into things with his guests. He is an advocate of the capital markets. This interview was a great insight for James and his viewers to learn about the great opportunity in the private capital markets that is emerging.

November 7, 2019

TalkCents Radio based in UAE interviews KoreConX Director MENA

So much of blockchain is spoken in USA, Europe here is TalkCents coming live from Dubai, UAE. TalkCents brings the latest leaders in the MENA region. Our very own Edwin Lee has an opportunity to speak to TalkCents and discuss how KoreConX’s solution in the MENA region is leading for those who are looking to […]

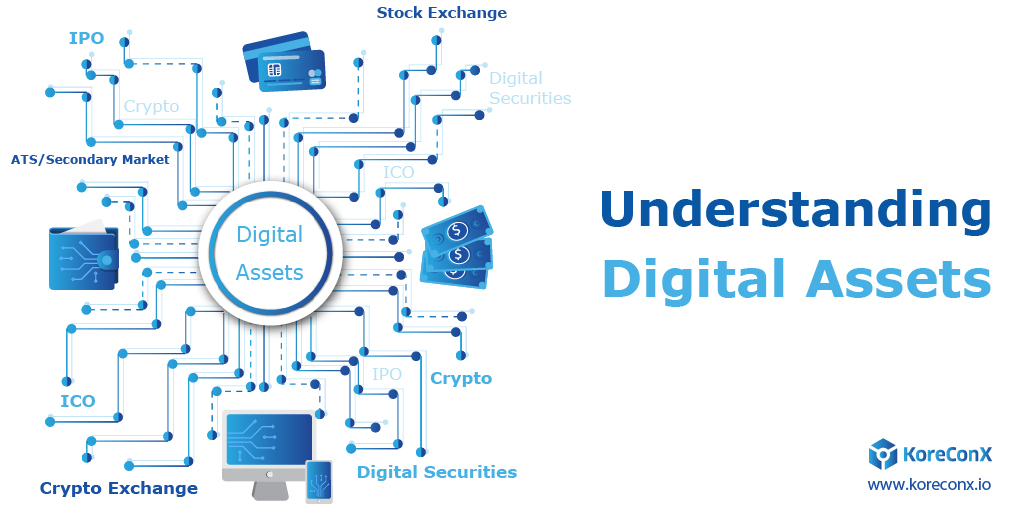

September 4, 2019

Understanding Digital Assets

There has been a lot of talk in recent years about crypto, tokens, blockchain, ICOs, STOs, Digital Securities, etc. What does it all mean and why should you care? In order to navigate the new financial digital world, it is important to first understand the terminology. Below, I have broken down the typical terms being […]

August 24, 2019

Facebook's Libra Reboots the Crypto World

Facebook Libra Project set’s to rebook the crypto world. Since the announcement by Facebook of their Libra Project, everyone in the world came out with their take on what Facebook was up to. Thousands of articles and interviews with everyone jumping in. It’s safe to say that what Facebook has done, no other company has […]

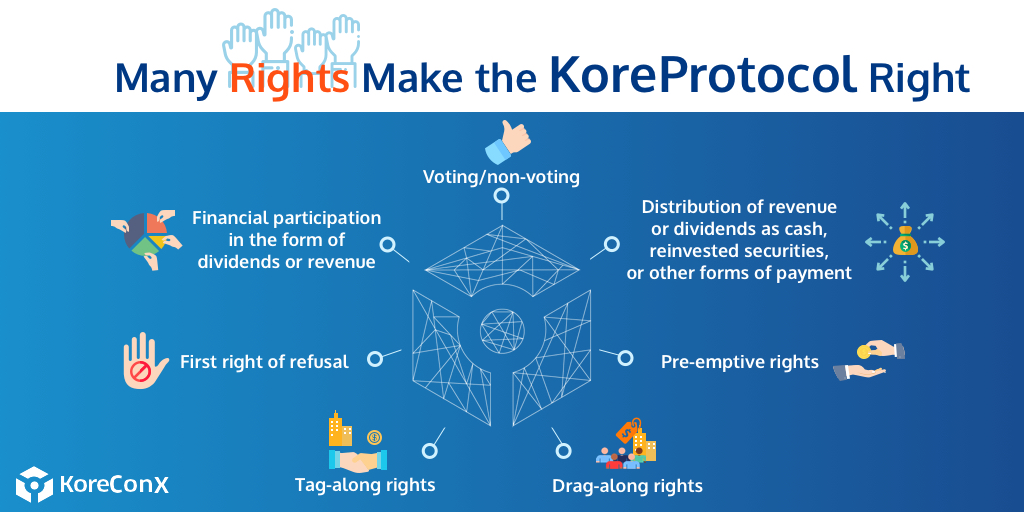

June 19, 2019

Many Rights Make the KoreProtocol Right

Over the last few weeks, we have seen the highly entertaining farce of Craig Wright claiming to be Satoshi Nakamoto by registering a copyright to the original bitcoin whitepaper and code. He may very well be Satoshi. However, registering a copyright does not confer an official recognition of identity. Wei Lu, CEO of Coinsumer, proved […]

June 17, 2019

Exempt Market Update 2019

The exempt market in Canada is going through some major developments that will fundamentally change how the private market will be seen by investors.Digital Securities provide companies, who are raising capital, the opportunity to offer their investors another potential exit that until now was only seen as a pipe dream.It’s no longer a dream, it’s […]

May 26, 2019

KoreConX launches $15M Digital Securities Offering using its own Fully-Compliant KoreProtocol

KoreConX is excited to announce its Digital Securities Offering that will utilize its own KoreProtocol. The KoreProtocol is the world’s first complete end-to-end protocol that has built-in AI to manage the entire lifecycle for tokenized securities, from issuance, trading, and all types of corporate actions. The global securities marketplace is changing, and the future is […]

May 22, 2019

Reg A+ Webinar: Q&A Part I

The content on this webinar and associated blogs are provided for general information purposes only and does not constitute legal or other professional advice or an opinion of any kind. During our last Regulation A+ webinar with Sara Hanks and Darren Marble, we received dozens of questions about the topic. As promised, we have answered […]

May 15, 2019

Minimizing Failure Vector Surfaces for Digital Securities

Modern capitalists and ancient Chinese may disagree on many things, but the one thing they do seem to agree on relates to security of the realm. George Washington, back in 1799, said, “…offensive operations, often times, is the surest, if not the only (in some cases) means of defence.” A similar sentiment can be seen […]

May 8, 2019

Meet the KorePartners: David Benizri, Rivver

This post is part of a series of short interviews about the companies and faces that are part of the KorePartners Ecosystem*. We believe that behind every great company there are people, and behind every person, there is a story to tell. KorePartner: David Benizri, CEO & Co-Founder at Rivver Born in: Montreal, Canada Based […]

May 2, 2019

Reg A+ Webinar: The Highlights

In our last webinar, we’ve talked about a very complex topic in the startup industry: The Regulation A+. For those of you who have never heard of it (no shame in learning, folks), Regulation A+, or Reg A, is a section of the JOBS Act that allows private companies to raise up to $ 50 […]

April 22, 2019

Digital Securities Webinar: Your Questions Answered!

We had an overwhelming response to our last webinar on Digital Securities. While Oscar Jofre and Darren Marble did their best to answer all the questions, we didn’t have time to go through it all. So as promised, here are the remaining questions from our Q & A on Digital Securities. If you missed the […]

April 16, 2019

Webinar sheds light on Digital Securities Terrain

The regulator’s message is clear: there’s no room for tampering with the regulation when it comes to capital raising, and many companies that invested time and energy on ICOs (Initial Coin Offering) are now facing the consequences. But that doesn’t mean that the private capital markets are dead when it comes to digital assets, on […]